30+ Who much mortgage can i borrow

This mortgage calculator will show how much you can afford. Excludes refinances from Bankwest and CommBank.

Http Www Usdebtclock Org Mortgage Debt Bad Debt Debt Settlement

How much can I borrow.

. You can calculate your mortgage qualification based on income purchase price or total monthly payment. Keep in mind how much you can afford to borrow without putting the rest of your financial plans on hold. Determine how much home you can afford with these helpful tips and questions to consider when budgeting for a mortgage.

Please get in touch over the phone or visit us in branch. On a 30-year mortgage with a 4 fixed interest rate youll pay over the life of your loan. With a 30-year mortgage.

A jumbo loan is meant for home buyers who need to borrow more than 647200 to purchase a home. How much can I borrow Find out how much you could borrow with our calculator. Loan must be funded by 30 April 2023.

Borrow from 8 to 30 years. This calculator provides useful guidance but it should be seen as giving a rule-of-thumb result only. An easy way to do the math and compare the payment amounts for a 106 ARM and 30-year fixed is with a mortgage payment calculator.

Fill in the entry fields and click on the View Report button to see a complete amortization schedule of the mortgage payments Bankrate. Your loan will surely be. When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you can borrow.

The average rate for a 30-year mortgage has topped 6 for the first time since 2008 hitting 602 this week. Thats about two-thirds of what you borrowed in interest. The longer term will provide a more affordable monthly.

If you already have a mortgage with us you can take your first direct mortgage with you when you move house known as. Total subsidized and unsubsidized loan limits over the course of your entire education include. However as a drawback expect it to come with a much higher interest rate.

How long will I live in this home. A 30-year mortgage will repay at a different pace than a 15-year or 20-year mortgage. So the value of the property can also limit how much you can borrow.

Your total interest on a 250000 mortgage. Fee-free valuation Fee Saver mortgages available too mortgage terms up to 40 years. You could get an agreement in principle that lasts 6 months sorted in a 30-minute phone call.

Find out what you can borrow. Our borrowing power calculator asks you to enter details including your loan term and interest rate income and expenses and any. Pay off higher interest rate credit cards pay for college tuition.

This mortgage finances the entire propertys cost which makes an appealing option. Over 170000 positive reviews with an A rating with BBB. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage.

30 1030 1130 1230 1330 1430 1530 1630 1730 Preferred time of day Sydney Time. Or 4 times your joint income if youre applying for a mortgage. By way of example say that Taylor a 30-year-old woman who is a first-time home buyer wishes to obtain a 30-year fixed FHA loan on a new home with a 20 down payment.

Cash out debt consolidation options available. Image for illustrative purposes only. Safis says the average rate difference between a 106 ARM and a 30-year fixed mortgage can be about 05 to 075.

Maximum additional loan term is 25 years if any element of your mortgage is on interest only. For example with a 30-year fixed-rate mortgage your payments are spread throughout 360 monthly payments. That can greatly impact your decision on whether to choose a 30-year fixed rate loan or a shorter term.

Mortgage advisers available 7 days a week. However when interest rates are rising its a different market. You can take a 100 percent mortgage if youre looking to secure a home loan without making a deposit.

If you instead opt for a 15-year mortgage youll pay over the life of your loan or about 46 of the interest youd pay on a 30-year mortgage. The mortgage qualifier calculator steps you through the process of finding out how much you can borrow. A 30-year mortgage gives homeowners 30 years to pay off their mortgage.

Depending on how youre planning to pay back your interest only mortgage we may restrict your additional loan term to your current mortgage term. Just plug in your loan amount. Below you can get a sense of just how much that she stands to save given a 1 difference in interest savings on her 30-year mortgage.

You can also calculate your monthly repayments and interest rate. Eligibility requirements and TCs apply. 31000 23000 subsidized 7000 unsubsidized Independent.

This can help you build a stronger future because youll be better informed and better equipped to be a successful. 30-Year Fixed Rate Mortgage Rate. Early in the repayment period your monthly loan payments will include more interest.

For borrowings up to 90 including lenders mortgage insurance of the property value. Your income expenses and deposit are the biggest factors determining your borrowing power but lenders also consider other factors such as your existing debts and if you are using a guarantor for the loan. Contact New American Funding today to see how much you can save.

How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income.

How Is Buying A House With A Mortgage A Good Investment If You End Up Paying Nearly Double Because Of The Interest 350k Loan 3 375 Total Is Over 500k By The End

5 Financial Goals You Should Achieve By Age 30 Forbes Advisor

Why Do We Allow People To Take 30 Years To Pay Off Mortgages When We Sell Them A House Quora

Best Mortgages In Canada Comparewise

![]()

Homewise Review Loans Canada

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

What Are Some Of Ideas You Can Use To Pay Off Your Mortgage Quicker Quora

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Best Mortgages In Canada Comparewise

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Dave Ramsey In Most Places Homes Cost A Lot More Than This Example But The Proportions On This Comparison Remain The Same A 15 Year Mortgage Is The Only Way To Go

Line Of Credit Mobile Dashboard Line Of Credit Lending App Banking App

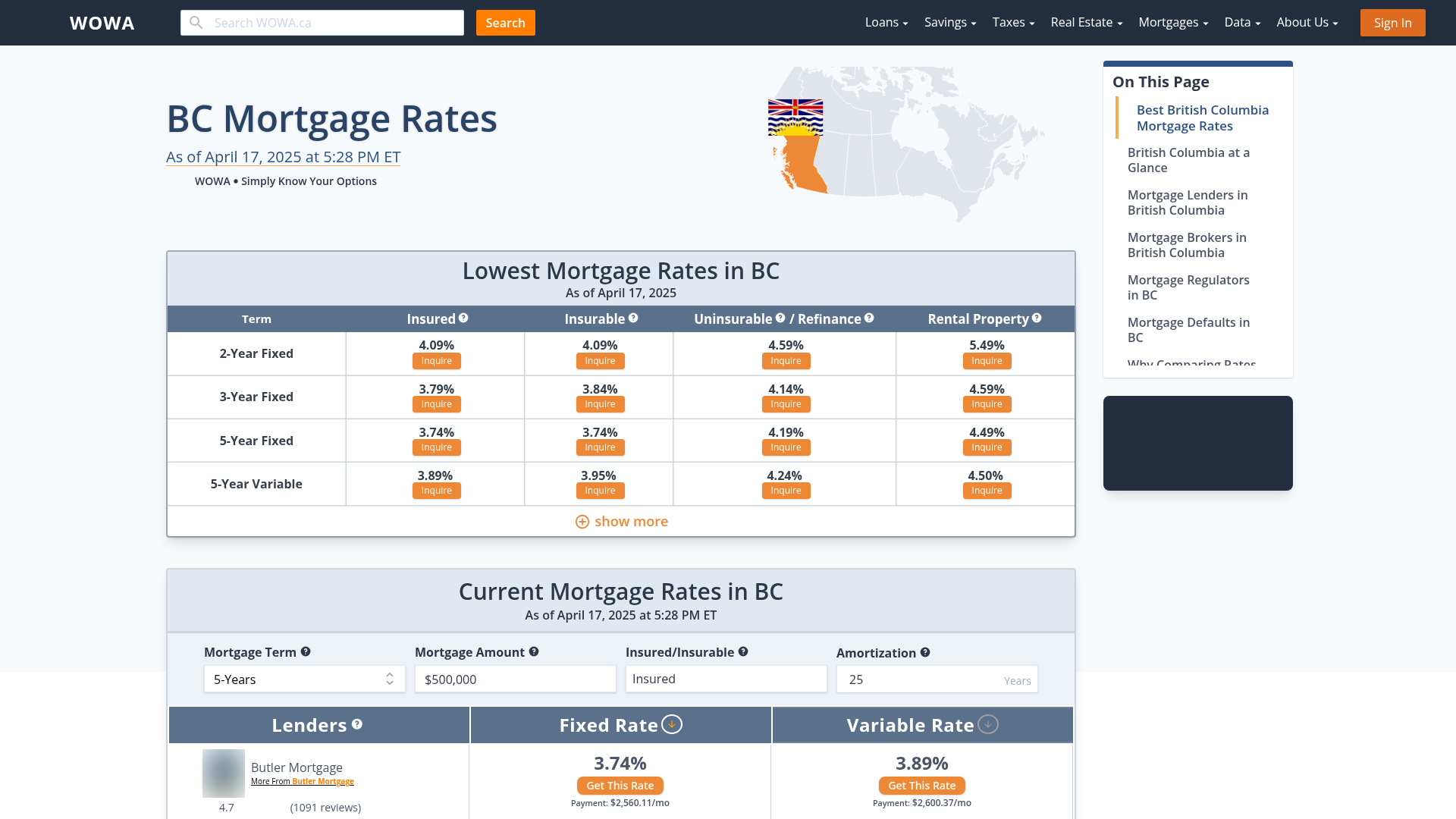

British Columbia Mortgage Rates From 30 Bc Lenders Wowa Ca

30 Year Fixed Mortgage Loan Or An Adjustable Rate Mortgage Arm

What Would My Yearly Salary Have To Be To Afford A 2m House Quora